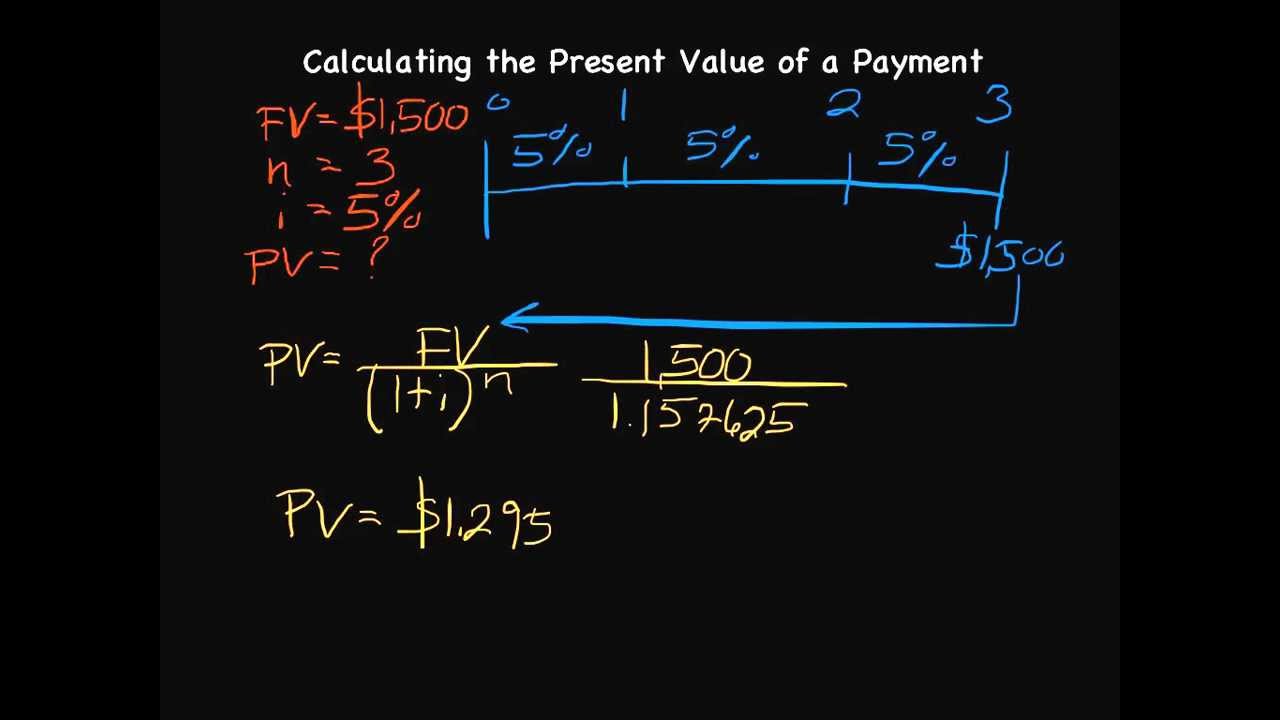

Compute present value

The entire method invocation is performed atomically. In the Shared tier each app receives a quota of CPU minutes so each app is charged for the CPU quota.

Present Value Formula Calculator Examples With Excel Template

All data in a Python program is represented by objects or by relations between objects.

. Value from present value of 1 table. PV Present value also known as present discounted value is the value on a given date of a payment. The project seems attractive because its net present value is positive.

Source Code ZIP File. In the dedicated compute tiers Basic Standard Premium PremiumV2 PremiumV3 the App Service plan defines the number of VM instances the apps are. Lets use the following formula to compute the present value of the maturity amount only of the bond described above.

Property that is directly contained by its object. Present Value Of An Annuity Based on your inputs this is the present value of the annuity you entered information for. The currently calculated monthly payment.

Objects are Pythons abstraction for data. This lets us find the most appropriate writer for any type of assignment. Before proceeding further let us understand a few important concepts.

In statistics quality assurance and survey methodology sampling is the selection of a subset a statistical sample of individuals from within a statistical population to estimate characteristics of the whole population. If the value is -1 then the Z offsets of all the points probed are printed but no calibration is done. 1238 M39 Report SD card information.

With a tilde and appears to be blank there is a space tab newline or some other non-viewable character present. Compute mean over 5 rating variables if at least 3 valid values are present. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Annual Coupon Rate is the yield of the bond as of its issue date. Please review the below and indicate your acceptance to receive immediate access to the Compute Express Link Specification 30.

See also our Annuity Mortgage and Loan Future Value. Statisticians attempt to collect samples that are representative of the population in question. Operation Modes While working with the vi editor we usually come across the following two modes.

Examplediscounted present value or DPV. Objects values and types. Present value is compound interest in reverse.

In addition you can use the calculator to compute the monthly and annual payments to save a certain amount of money future value for retirement education etc. SPSS COMPUTE sets values for new or existing numeric or string variables. The business intends to receive an income of 120000 for infinite tenure.

Use the Bond Present Value Calculator to compute the present value of a bond. Sampling has lower costs and faster data collection than measuring. Using the formula to determine the present value we have.

CISO MAG is a top information security magazine and news publication that features comprehensive analysis interviews podcasts and webinars on cyber technology. Source Code TAR Ball. Step 6 To arrive at the present value of the perpetuity divide the cash flows with the resulting value determined in step 5.

THE UNIQUE VALUE THAT IS PROVIDED IN ANY CXL SPECIFICATION IS FOR USE IN VENDOR DEFINED MESSAGE FIELDS DESIGNATED VENDOR SPECIFIC EXTENDED CAPABILITIES AND ALTERNATE PROTOCOL. It is also referred to as discount rate or yield to maturity. Except for Free tier an App Service plan carries a charge on the compute resources it uses.

You now have one open file to start working on. Some attempted update operations on this map by other threads may be blocked while computation is in progress so the computation should be short and simple and must. Finding the amount you would need to invest today in order to have a specified balance in the future.

Future cash flows are discounted at the discount. Present Value - PV. If the value is zero or not present then this specifies that the number of factors to be calibrated is the same as.

1237 M38 Compute SHA1 hash of target file. All of this is shown below in the present value formula. Compute the total value of dividend income as displayed below.

The maturity amount which occurs at the end of the 10th six-month period is represented by FV The present value of 67600 tells us that an investor requiring an 8 per year return compounded semiannually would be willing to invest 67600 in return for a. PaymentWithdrawal Frequency The paymentdeposit frequency you want the present value annuity calculator to use for the present value calculations. Property of an object that is not an own property but is a property either own or inherited of the objects prototype.

Internal value that defines some characteristic of a property. The premise behind the calculation is the concept of the time value of money or in other words that its more valuable to receive something today than to receive the same value at a future date which is why. If the value for the specified key is present attempts to compute a new mapping given the key and its current mapped value.

Get 247 customer support help when you place a homework help service order with us. This is because 6 is a user missing value and its used in a basic numeric function. In a sense and in conformance to Von Neumanns model of a stored program computer code is also represented by objects.

Delete If this value is used the data disk is deleted when the VMSS Flex VM is deleted. The currently calculated annual payment. Picard is a set of command line tools for manipulating high-throughput sequencing.

You can also sometimes estimate present value with The Rule of 72. Calculation Using a PV of 1 Table Use the PV of 1 table to find the rounded present value factor at the intersection of n 20 and i 10. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Detach If this value is used the data disk is retained after VMSS Flex VM is deleted. Compute net present value of the project if the minimum desired rate of return is 12. The cash inflow generated by the project is uneven.

See How Finance Works for the present value formula. Face Value is the value of the bond at maturity. Compute mean_score mean3doctor.

Therefore the present value would be computed for each year separately. Let us then take the example of a trading business. A set of command line tools in Java for manipulating high-throughput sequencing HTS data and formats such as SAMBAMCRAM and VCF.

Present value is a formula used in finance that calculates the present day value of an amount that is received at a future date. It is important to understand that the three most important components of present value are time expected rate of return and the size of the future cash amount. Among other places its used in the theory of stock valuation.

View the Project on GitHub broadinstitutepicard. Mostly used for computing means or sums over other variables. Bond Present Value Calculator.

PV FV1r n. To calculate the present value of receiving 1000 at the end of 20 years with a 10 interest rate insert the factor into the formula. The default value is set to Delete.

The interval can be monthly quarterly semi-annually or annually. Specifies the Read-Write IOPS for the managed disk. Annual Market Rate is the current market rate.

James Stith This Shows In Different Terms And Currency To Calculate Accounting Rate Of Return Arr

1 Ba Ii Plus Cash Flows Net Present Value Npv And Irr Calculations Youtube Cash Flow Calculator Financial Decisions

Present Value And Future Value Formula For Scientific Calculator Input Scientific Calculator Annuity Lins

Present Value Of An Annuity How To Calculate Examples

Present Value Of A Single Cash Flow Finance Train

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Present Value Formula With Calculator

How To Calculate Present Value Youtube

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Decision Making Using Npv Decision Making Investing Flow Chart

Present Value Factor Formula Calculator Excel Template

Calculating Present And Future Value Of Annuities Annuity Time Value Of Money Annuity Formula

Formula For Calculating Net Present Value Npv In Excel Formula Excel Economics A Level

Calculating Present Value Accountingcoach

Present Value And The Opportunity Cost Of Capital Mgt535 Lecture In Hindi Urdu 03 Youtube Cost Of Capital Opportunity Cost Lecture

Calculating Present Value Of An Annuity Ti 83 84 141 35 Youtube Annuity Calculator Investing

Present Value Table Investment Analysis Financial Calculators Meant To Be