Share dilution calculator

509 x2035. Calculate Fully Diluted Shares.

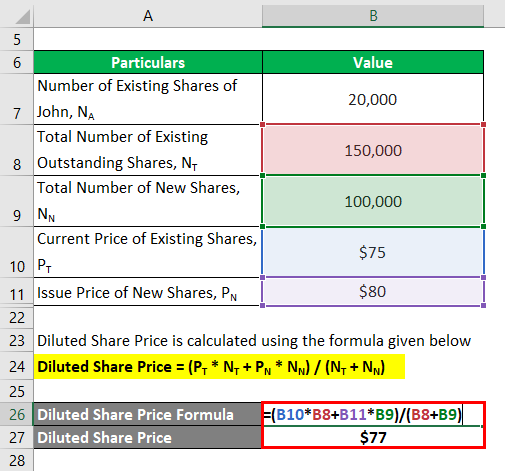

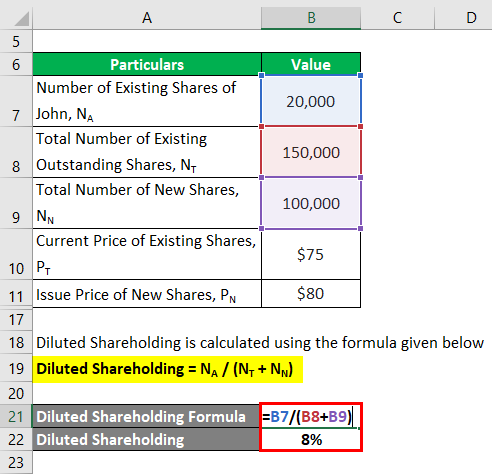

Dilution Formula Calculator Examples With Excel Template

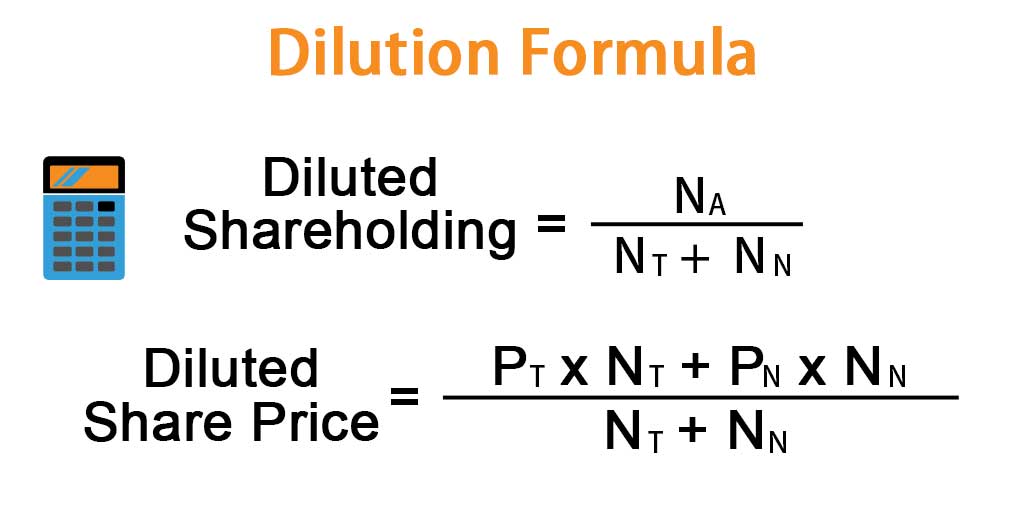

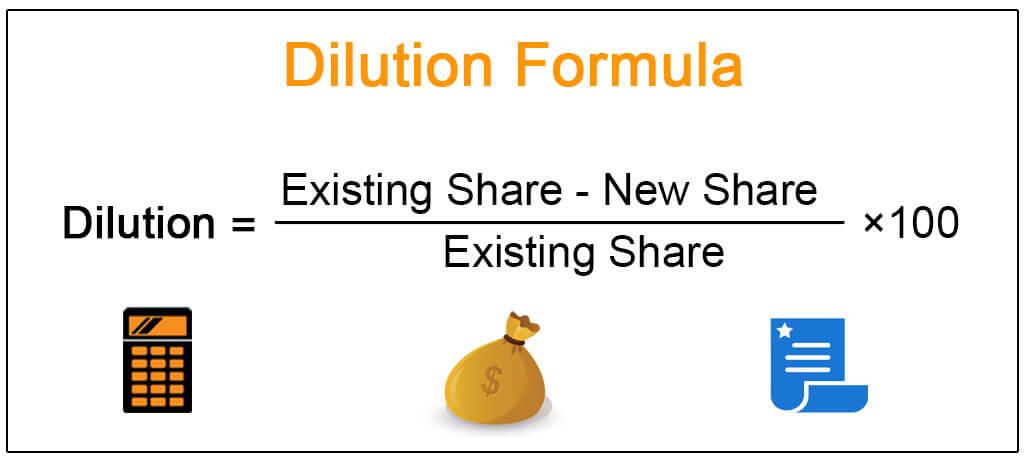

Understand the dilution formula.

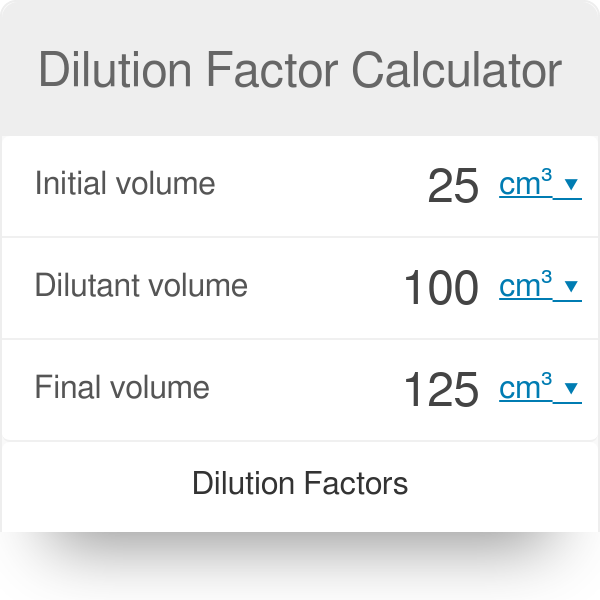

. According to entrepreneur and equity thought leader Paul Graham 1 dilution can be thought of in terms of the following simple stock dilution formula. This is the volume that results after V1 from the stock solution has been. Diluted EPS 50000000 200000 15000000.

C2 is the final concentration of the diluted solution. Dilution not only affects the share. The post-money dilution of series-a is 20 and the ESOP is 10.

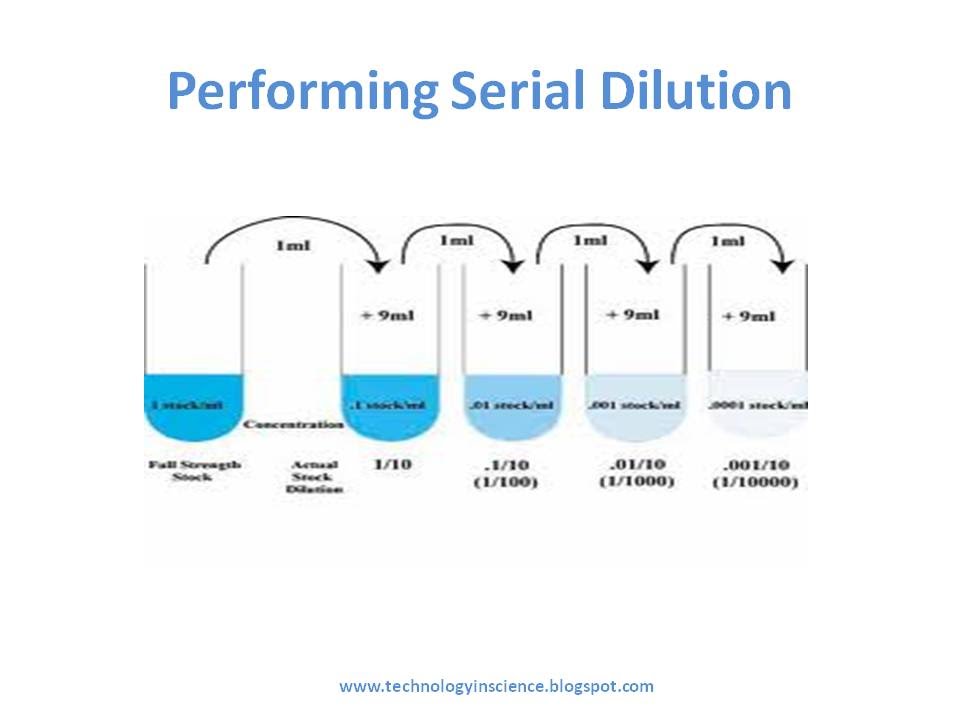

Share Dilution naturally makes a negative impact on investors as it reduces individual investment value. Dilute Solution of Known Molarity. The dilution ratio is the ratio of the solute the substance to be diluted to the solvent eg waterThe diluted liquid needs to be thoroughly mixed to achieve true dilution.

Diluted EPS Net Income Dividend on Preferred Stocks Outstanding Shares Diluted Shares Here is the workout. Let us say that a company has issued 100 shares to 100 shareholders. This is because when the post-money 10 option pool is set up everyone is diluted 125 before investment.

To use the calculator simply enter the currency the amount you are raising the post-money equity percentage you are offering to investors and the number of. Using the equation C 1 V. Capboard offers several free tools for calculating and managing fully diluted shares.

Simply we can calculate dilution in a cap table by subtracting the percentage of ownership before investment No. Again if net income was 10000000 and 500000 weighted average common shares are outstanding basic EPS equals 20 per share 10000000 500000. Calculating dilution from convertible notes and SAFE vehicles is quite tricky and most entrepreneurs dont know exactly how much equity theyve given up.

So you divide the 20 by 1 minus the ESOP you need. Of outstanding shares from. The equation is as follows.

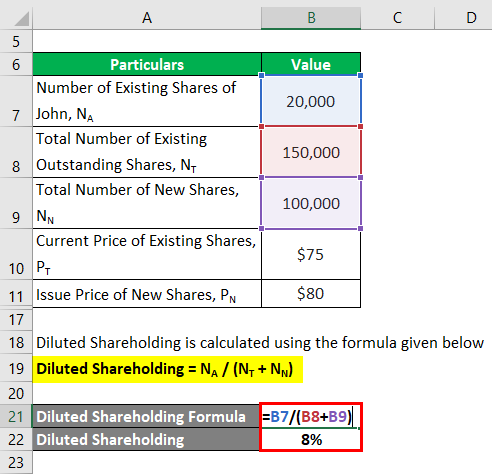

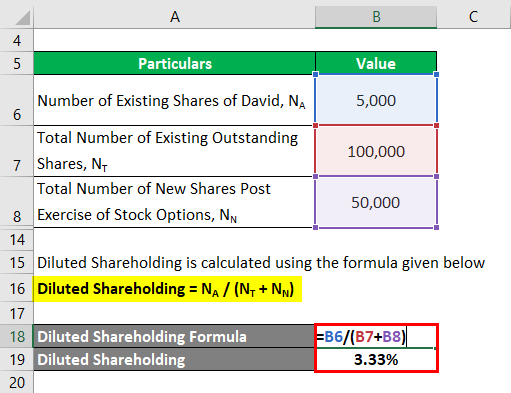

That rounds up the amount to the amount pre-investment of 125. Let us take a simple example first to explain share dilution calculation. Thus leading to founder dilution.

V2 is the final volume of the diluted solution. This means that each shareholder owns 1 of the. The number that you get would be the additional shares that would be there if the maximum possible dilution.

Once you have all the figures add them. Dilution affects the value of a portfolio depending on the number of additional shares issued and the number of shares held. Ideal to simulation how many shares need to be issued to a new shareholder to own.

An example of a dilution calculation using the Tocris dilution calculator What volume of a given 10 mM stock solution is required to make 20ml of a 50 μ M solution. Value of ownership after dilution 1 n -. Effect of Dilution.

The solution dilution calculator tool calculates the volume of stock concentrate to add to achieve a specified volume and concentration. The dilution at series a is 20 and the ESOP is 10. So you divide the.

Its a proportionate calculation because you need to calculate at the same time how many shares to give him and the new total.

Serial Dilution Methods Calaculations Youtube

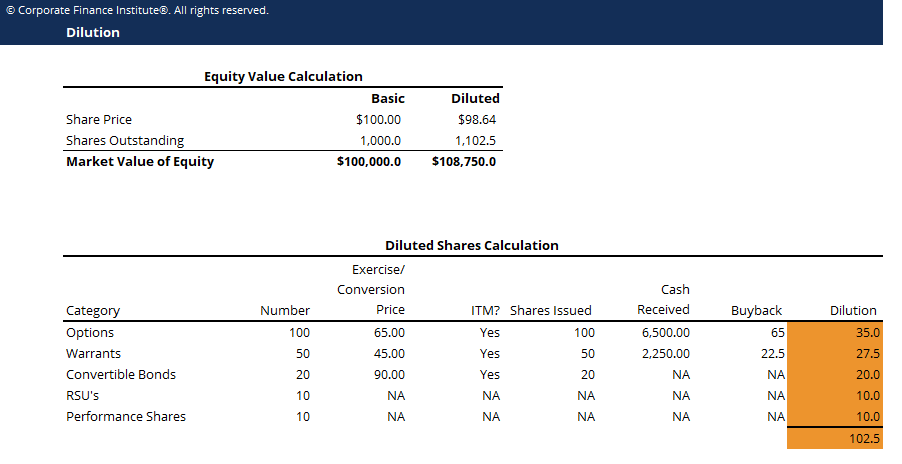

Treasury Stock Method Tsm Formula And Calculator Excel Template

Treasury Stock Method Tsm Formula And Calculator Excel Template

Dilution Factor Calculator

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

Capital Raise Dilution And Value Calculator Bradley Birchall

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Dilutive Securities Example Of How Dilution Impacts Share Prices

Dilution Formula Calculator Examples With Excel Template

Treasury Stock Method Tsm Formula And Calculator Excel Template

Treasury Stock Method Tsm Formula And Calculator Excel Template

Equity Dilution Meaning Formula How To Calcuate

Dilution Formula Calculator Examples With Excel Template

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

Dilution Formula Calculator Examples With Excel Template

Dilution Calculator Percent Factory Sale 55 Off Sportsregras Com

How To Calculate Equity Dilution In An Investment Round Therodinhoods